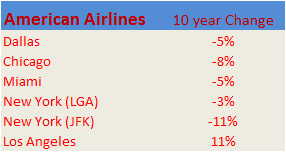

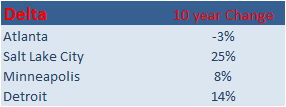

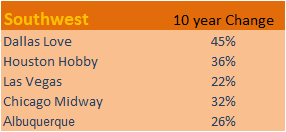

Travel Management is a tough business – we’re constantly challenged to explain complex systems and interactions among multiple vendors managed through a dozen systems. Vendors don’t make it easy. Airlines benefit when employees search out of policy for the lowest fares and inevitably compare a three day advance purchase against a twenty-one day AP offered on countless websites. Airlines have also monetized many benefits travelers took for granted three or four years ago. Government regulations have forced airlines to offer more transparent pricing which has led to improvements that protect travelers. Comparison shopping is more effective now since most fees and taxes must be disclosed up front.

Airlines suffered from unexpected fuel price spikes beginning in late 2005; since prices have remained volatile consumer awareness about the problem is very high. Airline marketers have learned how to transform their pain at the gas pump into revenue. Fuel prices routinely exceed labor as legacy airlines’ highest expense. Carriers add fuel surcharges aggressively to capture more revenue from each seat, and most travelers have no idea how much fuel their flights consume – this awareness gap has allowed carriers to regain pricing power.

Data from the U.S. Department of Energy.

Fuel surcharges stand out as an especially onerous fee since they are ineligible for corporate discounts and can even exceed the base fare for some flights. Let’s face it, we’ve seen some big fuel surcharges in the past few years.

All of this has me wondering how much of the passenger’s fuel bill does the surcharge cover? Here’s the punchline: in many cases airline fuel surcharges exceed the cost of fuel needed to carry the passenger. That’s right – surcharges don’t just offset the incremental cost of higher fuel prices, they often exceed the total fuel bill. Customers and clients share a widespread belief that surcharges represent a fraction of the gas bill and most are surprised to learn the truth.

Surcharges have been expanding on domestic flights in the US, but are more commonplace on long-haul, International flights. They are usually applied by Origin and Destination without regard for the passenger’s ticketed cabin. The airlines have generally approached these surcharges as “one size fits all.”

Typical charges for Atlantic flights are $200 each way (between New York and London), while Pacific charges are more likely to be $400 per passenger each direction (between Chicago and Hong Kong).

The fee is not arbitrary, but I wanted to determine if coach passengers were being asked to subsidize the higher fuel costs required to move a passenger in Business Class or First Class? Essentially, is each seat carrying a burden relative to its density or floorspace requirement?

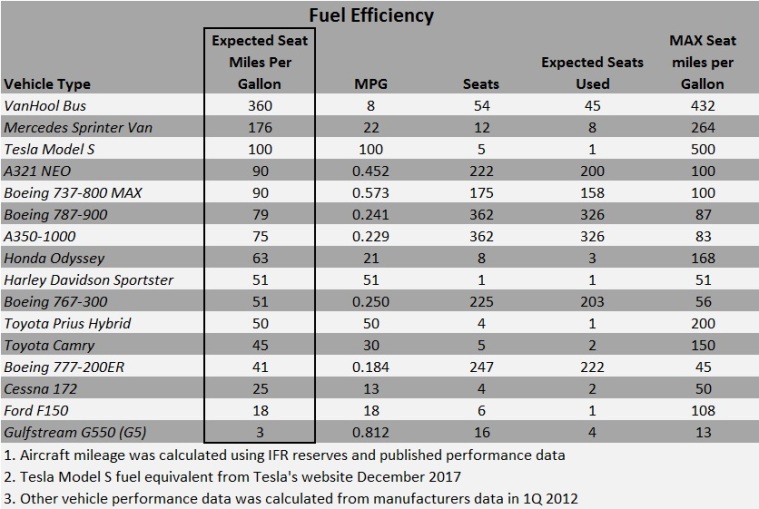

The key to this question is to calculate the fuel required for each seat then multiply that result by a particular airline’s average fuel expense (available in their annual reports). Airlines select aircraft for their operating costs and reliability. I’ve selected a Boeing 777-200 for this analysis since they are currently in production and can be found on routes across both the Atlantic and the Pacific. Although not as large as the Airbus A380 or Boeing 747-400, the 777 is much larger than some of the Boeing 767’s and 757’s in the Atlantic market. Next, a review of the interior configuration options at Boeing’s website demonstrates that a business class seat requires about twice as much space as a coach seat, and a first class seat requires double the amount for business class when you consider galleys and lavatories. Boeing reports the 777-200 aircraft could hold 440 seats in a coach class configuration; combined with other performance data I determined this plane can achieve 81 miles per gallon for each passenger in an all coach cabin. For these calculations our model aircraft holds 301 passengers, with 227 in coach, 58 in business class and 16 in first class. Normalizing the results as described above gives us the results displayed in the table below.

*$2.50 per gallon Jet A

The evidence is clear and I was surprised that fuel surcharges actually covered more than the fuel expense for the seat. Coach passengers may be subsidizing other passengers, but given the competitive fare environment it’s unlikely that $1,000 round trip fares to Asia are covering their fully allocated costs. The real story is that rising fuel expenses threaten to overwhelm carriers, and at least for now, travelers in premium cabins are catching a break from an unpredictable expense. This led to my next question, what do I do with this information?

Travel Managers must be able to plan. For this reason, well-known Industry forecasts are always in high demand and fuel is often featured as the largest unknown variable. Since fuel is a volatile input it makes sense to create a sensitivity table that shows us the per mile fuel expense to provide information that allows us to predict pricing action in a particular market. You can find current fuel price information at the US Department of Energy website. To use the table: 1. find the current fuel price in the left column; 2. select the price per mile rate that corresponds to the cabin your travel policy allows; 3. multiply the O&D distance for a specific market. You can find mileage information in your GDS, or at Flightaware.com. Flightaware is an excellent source for real-time operating statistics about most flights – consider adding it to your bookmarks.

At $2.50 per gallon, the fuel expense works out to little more than 3.2¢ per mile for each coach seat, double that for business class and around 13¢ for a seat in first class. Although I ignored the revenue generated by cargo, which would reduce the cost burden on passengers, I also left out a load factor adjustment that would drive the per seat costs higher.

The next time someone asks you about a fuel surcharge, you’ll have everything you need to show them how reasonable the expense is – or isn’t.

If you’re interested about commercial aircraft fuel economy you should read another post from me: